11 Life Insurance Marketing Strategies to Boost Sales

insurance, conversational ai, insights,

When marketing life insurance, it’s crucial to convey everything that beneficiaries stand to gain from it.

Additionally, you must motivate potential customers to:

- Assess their financial goals.

- Evaluate risks.

- Take proactive steps to secure their future.

Curious to learn how it’s done?

We’ll walk you through eleven powerful life insurance marketing strategies for each stage of the buyer’s journey. Use them to learn how to develop an effective life insurance marketing plan.

Finally, explore how call tracking can be the game-changer in your life insurance marketing arsenals and discover the ultimate call tracking solution for your business.

This Article Contains:

- 11 Powerful Life Insurance Marketing Strategies

- How Marketing for Life Insurance Can Boost Sales

- How to Develop an Effective Life Insurance Marketing Plan

- How Call Tracking Can Supercharge Life Insurance Marketing Success

- Boost Your Life Insurance Sales with iovox Insights

Let’s get started!

11 Powerful Life Insurance Marketing Strategies

No marketing strategy is a one-size-fits-all solution.

Your company’s marketing must address the changing needs of a buyer as they pass through the various decision-making stages.

To help you figure out the best solution for each phase, we’ve categorized these strategies under the awareness, consideration, decision, and post-purchase stages:

Dive into them to figure out what works best for your target audience.

Awareness Stage

Your target audience is out there.

But at this stage, they may not know about your product or even if they need life insurance.

Your life insurance company can take this opportunity to educate potential customers about the basics of life insurance, its purpose, and the importance of financial protection.

Drive Customer Engagement Through Social Media

Social media platforms like TikTok, Instagram, Facebook, LinkedIn, and Twitter are excellent channels for advertising life insurance products.

The vast social media platform user base allows you to cast a wide net for prospects.

But here’s the thing: You must find creative ways to stand out, especially in the digital marketing world.

For example, Allstate Insurance developed an animated video emphasizing the significance of life insurance. It informs viewers that life insurance provides a tax-free payout to beneficiaries, which can be used for funeral expenses, housing costs, etc.

Collaborate with Influencers for Greater Impact

Influencers give your life insurance company a valuable opportunity to tap into their dedicated following and expand your online presence.

Insurance professionals can create engaging content around life insurance products by partnering with influencers in finance, lifestyle, and family content niches.

For instance, Northwestern Mutual successfully collaborated with influencers during the COVID-19 pandemic to break down barriers associated with financial planning.

These influencers used personal stories about how they navigated essential financial and emotional life stages during the pandemic.

Building on this success, Northwestern Mutual further transformed its social channels to provide financial services and guidance from its advisors.

Unlock the Power of Search Engine Optimization (SEO)

SEO can help your company attract individuals actively seeking information or services related to life insurance via search engines.

To make the most of SEO, follow these strategies:

- Conduct thorough keyword research to identify potential customers' search terms and phrases.

- Strategically incorporate these keywords into your website's content, meta tags, headings, and URLs to demonstrate relevance and value to search engines.

- Implement local SEO strategies if your target market is specific to certain geographic areas.

- Include location-specific keywords and optimize your Google My Business listing to appear in relevant local business search results.

SEO tools like Ahrefs or Moz can help you select the right keywords to target.

But remember, SEO is a long-term strategy that requires continuous effort and monitoring data and metrics from tools like Google Analytics.

Note: Noticeable improvements in search engine rankings and organic traffic generally take several months.

Network at Insurance Industry Events and Trade Shows

Besides learning about new trends, industry events, and trade shows offer excellent opportunities for brand exposure, lead generation, and partnerships.

That's because you can connect and share business cards with a relevant and engaged audience, including potential clients, industry professionals, and the media.

Some of the top conferences in the US include:

Tip: Independent agents or life insurance companies can contact event organizers for speaking opportunities or sponsorships.

Consideration Stage

In this stage, people gather information, assess choices, and consider different factors affecting their decision.

Life insurance professionals must offer comprehensive information about their products, coverage options, and unique value proposition (UVP).

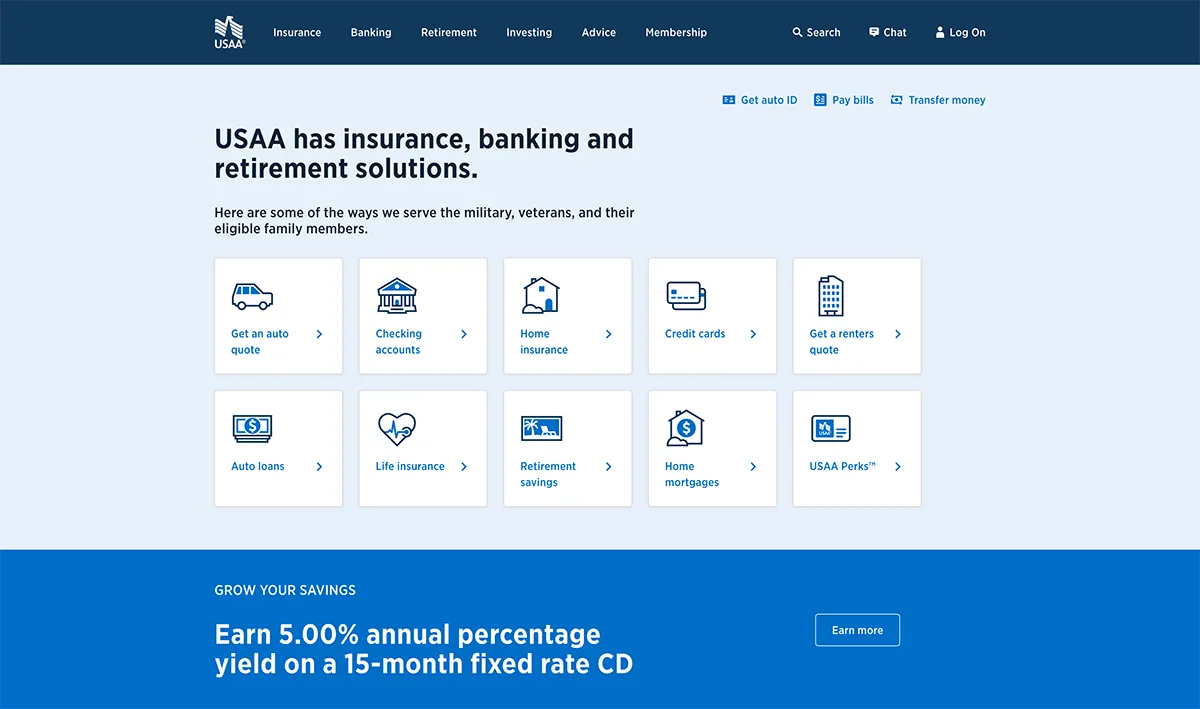

Create a User-Friendly Website

A well-designed and easy-to-navigate website instills confidence and trust in potential new customers.

The USAA website's well-organized layout features easily accessible sections for insurance products, claims, and customer service.

Users can enjoy a seamless browsing experience on mobile devices like smartphones and tablets. Moreover, USAA prioritizes security and privacy with SSL certificates and other protective measures to safeguard users' personal information.

This comprehensive approach enhances the overall user experience and reinforces the website’s trustworthiness.

Develop Persuasive Content

You can leverage various content marketing formats, such as blog posts, articles, brochures, ebooks, videos, and infographics.

To make the most impact, create high quality content tailored to the needs and interests of your target audience.

Allianz demonstrated this approach through their campaign on World Oceans Day (June 8th) in the 90-second launch film titled 'The Fountain of Life.'

This narrative extends the swimming analogy, showing how preparedness in life alters one's perspective and boosts confidence in facing challenges.

Build a Successful Email Marketing Strategy

Life insurance marketers primarily focus on providing support during challenging moments.

However, building a solid rapport with customers during more favorable times is equally crucial.Fortunately, email marketing provides numerous opportunities for insurance companies to connect with subscribers and cultivate relationships even before customers need their services.

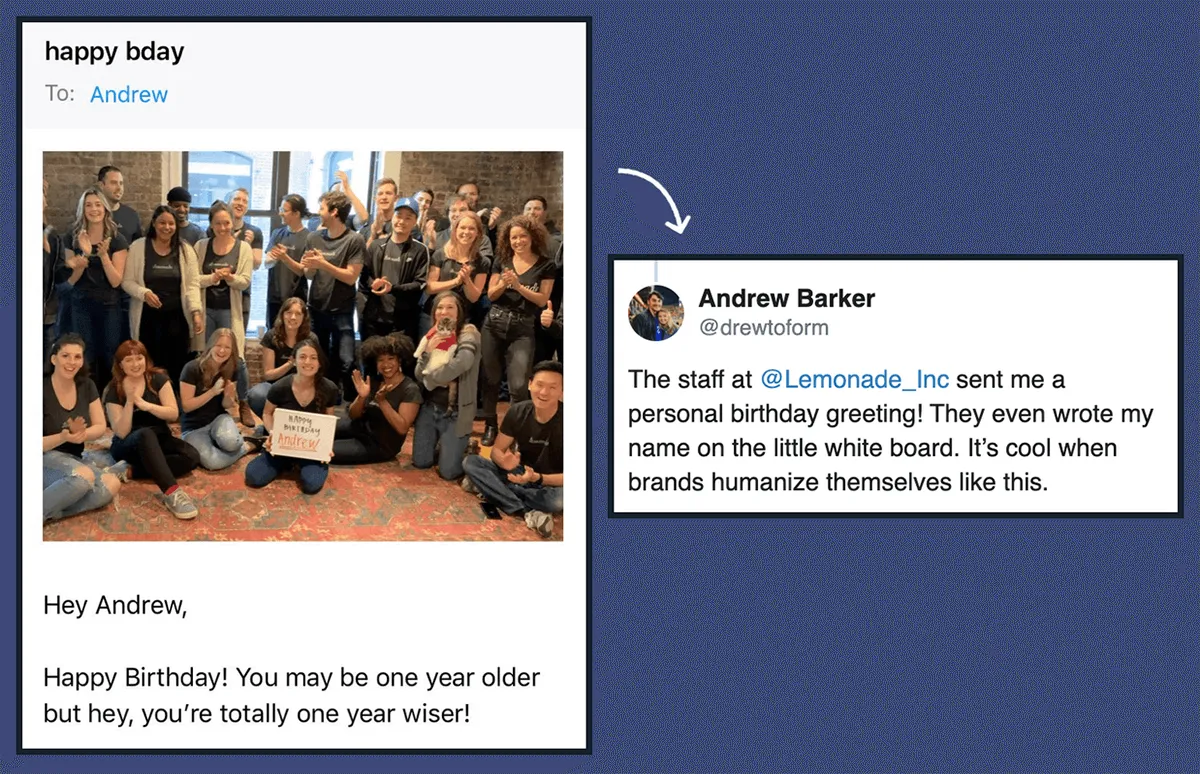

Lemonade Insurance caught attention with an impressively personalized and thoughtful birthday email.

Unlike the typical flood of generic coupons from other businesses, Lemonade Insurance used Photoshop magic, featuring staff members holding a handwritten message.

This attention to detail added a genuine and unique touch, resulting in a memorable and engaging experience for the recipients.

Expand Your Reach Through Insurance Comparison Websites

Insurance aggregators, or insurance comparison websites, are online platforms that let users compare various insurance products from different carriers.

Insurance marketers can use this comparison feature to ensure their products stand out with competitive pricing, comprehensive coverage, and other attractive benefits.

Moreover, many comparison sites offer contact forms where users can leave questions or ask for quotes. Insurance companies can use this contact information to get in touch with these qualified leads.

Some of the top insurance aggregators in the US include Insurify, Nerdwallet, and Policygenius.

Decision Stage

At this point, the potential client has a thorough grasp of their life insurance product requirements.

As an insurance agent or company, you must establish trust and ensure their brand remains top of mind while they make their decision.

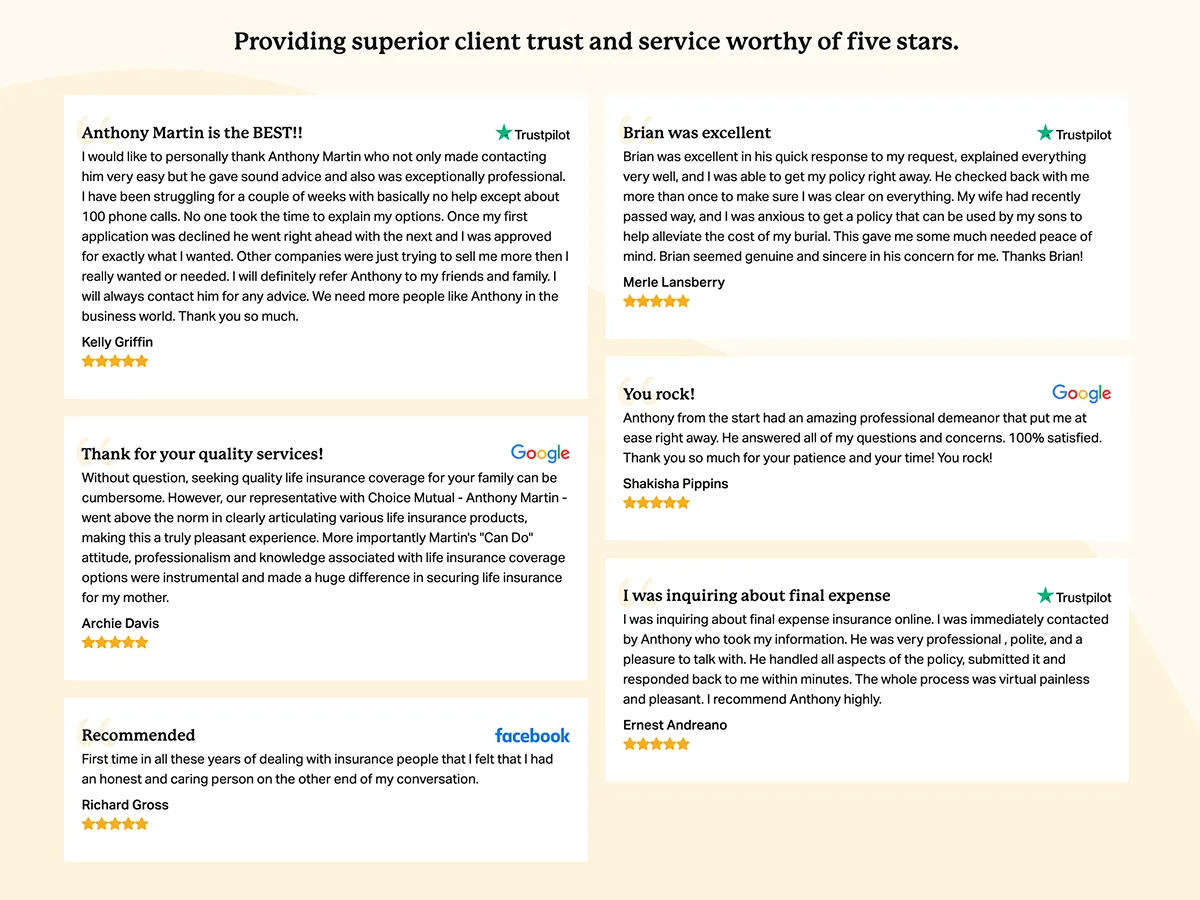

Leverage Online Reviews and Testimonials

Always request customer testimonials after completing a transaction with a client.

When clients have had a positive experience, they are more likely to be open to sharing their journey on your website and providing valuable insights that can benefit others.

Consider prominently displaying these positive reviews on your website.

You can take inspiration from Common Mutual, who have integrated reviews from reputable platforms such as Google, Trustpilot, and Facebook.

Master the Art of Targeted Ads

Facebook and Google ads offer powerful retargeting capabilities that enhance the likelihood of converting interested individuals.

For instance, both platforms allow you to create custom audiences based on specific user behaviors, such as:

- Visiting a particular website or landing page.

- Abandoning a quote form.

You can also use third-party sources to upload customer email addresses or phone numbers and create custom audiences for your retargeting campaigns.

To evaluate your pay-per-click (PPC) campaign performance, you can turn to WordStream, a valuable resource providing industry-wide benchmarks, including metrics like:

- Cost Per Click (CPC).

- Cost Per Conversion (CPA).

- Return on Ad Spend (ROAS).

- And Ad Impressions.

With these insights and the power of retargeting, you can achieve better conversion rates for your insurance business.

Post-Purchase Stage

Customers who encounter a responsive and knowledgeable team are more inclined to recommend your company to their friends, family, or colleagues.

To encourage this promotion, offering incentives for referrals can be an effective approach.

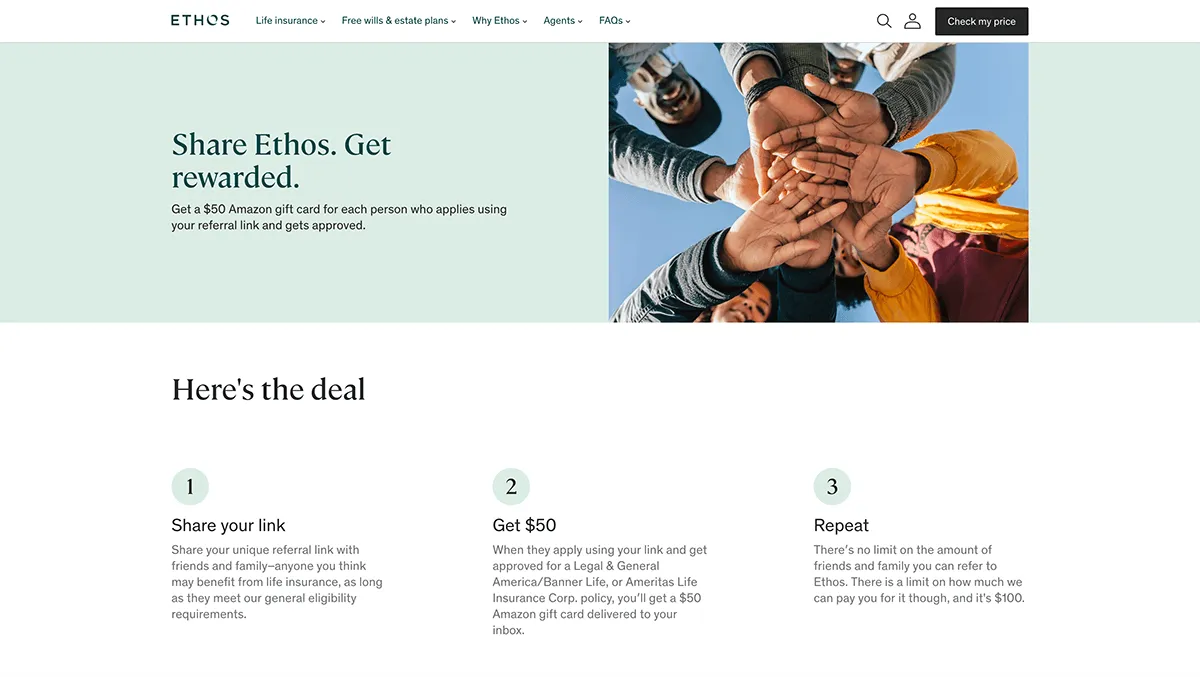

Develop an Effective Referral or Affiliate Program

Satisfied customers with positive life insurance policy experiences often become advocates, eager to refer the company to their friends, family, and colleagues.

When referred by someone they know and trust, potential customers tend to exhibit higher conversion rates and place greater trust in the company.

A prime example of an effective referral program is Ethos Life, a life insurance agency.

They established a referral program that rewards existing policyholders with a $50 gift card for each person who applies through a referral link and gets approved.

After exploring the various strategies applicable across different stages of the buyer's journey, let's examine the potential impact of them:

How Marketing for Life Insurance Can Boost Sales

Whether you want to increase brand awareness, establish trust, address existing client needs, or adapt to changing market trends, marketing life insurance can do it all.

Here’s how it works:

Increases Brand Awareness

Building brand awareness is about more than just initial exposure.

It's about staying top of mind with potential customers.You can maintain ongoing communication and nurture relationships with potential policyholders with the right marketing strategies.

This ensures that when they are ready to purchase a term life insurance product, your brand is the first that comes to mind.

Establishes Trust

Life insurance is an important and expensive purchase for most people.

Customers seek a reliable and trustworthy insurance agent or insurance carrier for this potentially life-changing product. You must showcase your expertise and instill confidence in potential clients to gain their interest.

One way to do this is by sharing customer testimonials, which allows satisfied policyholders to vouch for the company's credibility and excellent service.

Educates Customers

Life insurance is a complex product that can overwhelm potential customers, especially first-timers.

To address this knowledge gap, insurance marketers can:

- Offer personalized recommendations.

- Highlight the benefits of different coverage options.

- Address customers' concerns or questions.

This personalized approach enhances customer engagement and increases the likelihood of customers finding the information they need to make informed decisions about life insurance.

Helps You Adapt to Market Trends

Marketing empowers you to adjust your messaging in response to evolving market trends swiftly.

During the COVID-19 pandemic, marketing played a pivotal role in helping insurers to adapt to the shifting landscape.

Digital campaigns, for example, addressed individuals' changing concerns and priorities, highlighting the significance of financial protection during uncertain times.

This proactive approach enabled insurers to connect with their audience effectively and offer relevant solutions tailored to the pandemic's challenges.

But without a strategic marketing plan, all your efforts can go to waste.

So, let's explore the critical elements of a robust life insurance marketing plan.

How to Develop an Effective Life Insurance Marketing Plan

Here are seven steps to help you develop focused and effective life insurance marketing ideas that reach your target audience and differentiate your offerings:

Identify Your Target Audience

Conduct thorough research and deeply analyze your customer base to understand their demographics, interests, and pain points.

This knowledge will help you tailor your marketing messages and strategies to resonate effectively with your target audience.

Some typical target audiences for life insurance companies include:

- Working professionals.

- Retirees and seniors.

- Millennials.

- High net worth individuals.

- Business owners buying group insurance schemes.

Develop Your Unique Value Proposition (UVP)

Study your competitors' marketing strategies and offerings to identify opportunities for differentiation.

Analyze their strengths and weaknesses to carve out a unique position in the market and create compelling value propositions that set you apart.

Also, remember to communicate this across all marketing channels, including your website, social media, advertisements, and customer communications, in a consistent manner.

Define Key Marketing Strategies

Insurance marketers must choose the most suitable marketing tools and strategies to reach and engage their target audience.

For example, if your target audience includes millennials and retirees, crafting unique marketing plans for these distinct demographics might make sense.

Target millennials through digital marketing channels like blogs, articles, videos, and social media.

Meanwhile, for retirees and seniors, adopt direct mail and prioritize face-to-face meetings.Set a Budget

Determine your marketing budget based on your available resources and selected strategies.

For example, consider increasing SEO and social media marketing budgets in the months leading up to the new year, when people often make financial resolutions.

As you gather more data on conversion rates, you can allocate a larger budget to proven channels while reducing investment in underperforming ones.

Create a Marketing Calendar

Develop a detailed calendar that outlines your planned activities, marketing campaigns, and promotions throughout the year.

Consider using a seasonal calendar to target peak demand and create thematic campaigns to enhance your marketing strategy.

For instance, you may want to run a "Tax Season Preparedness" campaign featuring educational content about the tax benefits of life insurance and its role in financial planning.

Monitor and Optimize

Continuously monitor key metrics, analyze data, and gather insights to identify areas of improvement.

Some essential marketing metrics to track include:

- Customer Acquisition Cost (CAC): Average cost to acquire new clients. Ensures efficient and sustainable marketing spending.

- Customer Lifetime Value (CLV): Total revenue a customer generates over their relationship with your company. Helps prioritize customer retention efforts.

- Return on Investment (ROI): Measures marketing profitability by comparing revenue to final expense.

- Net Promoter Score (NPS): Tracks feedback to assess satisfaction and loyalty. Indicates positive customer experience and brand advocacy.

However, running a multi-channel marketing strategy can make tracking and measuring results time-consuming.

This is where call tracking comes in as the perfect solution.

How Call Tracking Can Supercharge Life Insurance Marketing Success

When purchasing life insurance, most customers prefer speaking with a life insurance agent to address their questions and concerns.

That’s where call tracking becomes crucial.

Call tracking is a powerful tool that assigns unique phone numbers to various marketing channels, including online ads and direct mail campaigns.

How does this help?

You can accurately track the source of each phone call and derive valuable insights into the effectiveness of your marketing efforts, such as:

- Which campaigns or advertisements generate the highest return on investment (ROI)?

- How to optimize your marketing budget and focus on the most effective strategies?

With these insights, you can focus on the most efficient channels, allocate budgets effectively, and gain a granular view of customers' interests and engagement.

Fortunately, you can easily leverage the ultimate call tracking solution to enhance your marketing endeavors.

Boost Your Life Insurance Sales with iovox

Iovox seamlessly integrates advanced call tracking and conversational AI into your marketing process.

With advanced call tracking, you can attribute calls to specific campaigns and sources, helping you calculate the cost per lead and customer acquisition cost (CAC).

Additionally, with conversational AI, you can extract keywords from customer interactions, allowing you to spot trends and optimize sales strategies.

Here’s how it works:

Advanced Lead Generation and Qualification Techniques

With iovox you can access valuable features like WebCallBack and Dynamic Numbers that help you capture quality leads.

WebCallBack is widgets on your website which allow potential customers to request a callback with just a simple click.

Similarly, iovox Dynamic Numbers are a pool of dedicated phone numbers to track website visitors, allowing you to track interactions, the customer journey, and optimize your ROI.

Using iovox solutions, Abeille Assurances achieved a 20% cost reduction and a 20% increase in quality insurance leads.

Identify Sales Growth Avenues

Powered by conversational AI, iovox Insights empowers users to analyze customer conversations to spot trends, opportunities, and outcomes at scale.

This valuable information empowers you to:

- Analyze keywords or key phrases of each call

- Identify the products or services that generate the most interest among your callers

- Uncover the key challenges your customers are discussing

For example, with iovox Insights, your life insurance agency can segment callers who express interest in retirement planning.

Armed with this knowledge, you can send follow-ups focused on retirement products, driving insurance sales growth.

Uncover Customer Experience Improvement Areas

iovox Insights transcribes call recordings, allowing you to quickly identify call quality issues such as non-compliance with call scripts.

Additionally,Insights helps identify keywords or phrases associated with privacy concerns.

This allows for targeted training and coaching to your salespeople to reduce call handle time and improve customer interactions.

But that’s not all.

By analyzing call patterns, keywords, and customer interactions, iovox Insights helps identify the most suitable agents or departments to handle specific calls.

This enables efficient and effective call routing, ensuring callers are connected to the most appropriate resource to address their needs.

Final Thoughts

Properly marketing life insurance can empower individuals, families, and businesses to make informed decisions about their future.

However, this process can be emotionally sensitive and time-consuming for your potential client.

Fortunately, you can achieve success by implementing the strategies in this post and topping them up with iovox Insights’ call tracking solutions.

With iovox Insights, you can generate more high-quality leads, spot upselling, and cross-selling opportunities, and elevate your overall customer experience.

To discover more about iovox Insights, click the iovox WebConnect call button on this page, and let’s connect.

You can email us at hello@iovox.com, connect with us here https://www.iovox.com/contact, or use the toll-free from within the United States by dialing +1 888 369 9519.

From outside the US please reach us at one of these numbers:

Las Vegas, USA +1 702 425 7505

London, UK +44 (0)20 7099 1070

Sydney, Australia +61 (0)2 8520 3530

Paris, France +33 (0)1 84 88 46 40